JLI’s Christoph Benn together with Patrik Silborn are contributors in a new book called Resilient Health: Leveraging Technology and Social Innovations to Transform Healthcare for COVID-19 Recovery and Beyond.

Innovative finance has become a prominent topic of the global discourse in the context of the global development finance. As a response to the growing gap in development financing between identified needs and available funding through the established sources, the UN organized the International Conference on Financing for Development in Monterrey, Mexico in 2002.

Since 2002, a range of international organizations, governments, and businesses have developed and implemented innovative financing instruments. The UN and its agencies, development banks, and multilateral platforms have also established commissions and studies about the promise – as well as the limitations – of innovative finance.

There are many definitions of innovative finance. The World Bank Group defines it as “any financing approach that helps to:

- Generate additional development funds by tapping new funding sources (that is, by looking beyond conventional mechanisms such as budget outlays from established donors and bonds from traditional international financial institutions) or by engaging new partners (such as emerging donors and actors in the private sector).

- Enhance the efficiency of financial flows, by reducing delivery time and/or costs, especially for emergency needs and in crisis situations.

- Make financial flows more results-oriented, by explicitly linking funding flows to measurable performance on the ground.

Although there are other definitions, they generally accord with the need to mobilize additional funding beyond domestic resources and ODA, increase the efficiency of development financing, and enhance development results.

During the early years of innovative finance, global leaders were particularly interested in exploring the use of new, earmarked taxes for development. In addition to exploring earmarked taxes, development actors implemented other innovative finance initiatives in the years following the Monterrey Consensus.

In the area of Global Health, the Global Fund to Fight AIDS, Tuberculosis and Malaria (the Global Fund), as well as the Gavi Alliance, pioneered a number of initiatives. These included consumer donations (RED), debt-swaps (Debt2Health), capital market solutions (IFFIm), and advanced market commitments to incentivize innovation and production of vaccines (Gavi AMC).

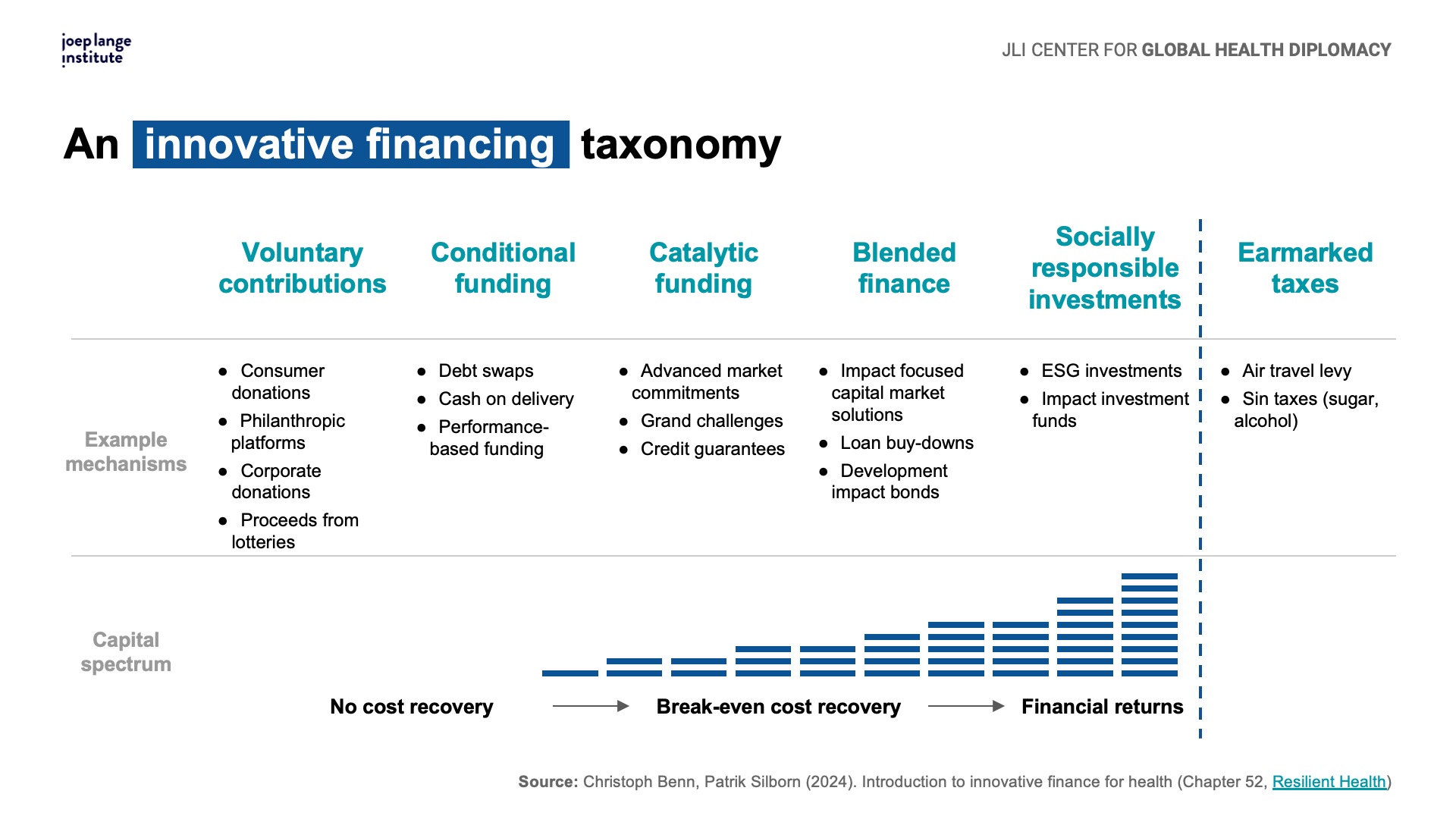

An Innovative Financing Taxonomy

Given the many definitions of what constitutes innovative finance, there are various taxonomies, or descriptions, of the innovative financing landscape and its mechanisms. The taxonomy presented here has been developed by the authors, influenced by the work of the Global Fund, USAID, and other organizations.

See the innovative finance taxonomy overview: (feel free to save a copy)