“Debt Swaps for Health are an Innovative Finance Mechanism that offers huge benefits particularly in the current environment as many countries in the Global South are burdened by unsustainable debt levels and donors find it increasingly difficult to come up with fresh money. Cancelling outstanding debt and making sure that the counterpart financing is invested in life-saving health programs is an elegant way to create a win-win situation for both partners“, Dr Christoph Benn, JLI Director of Center for Global Health Diplomacy

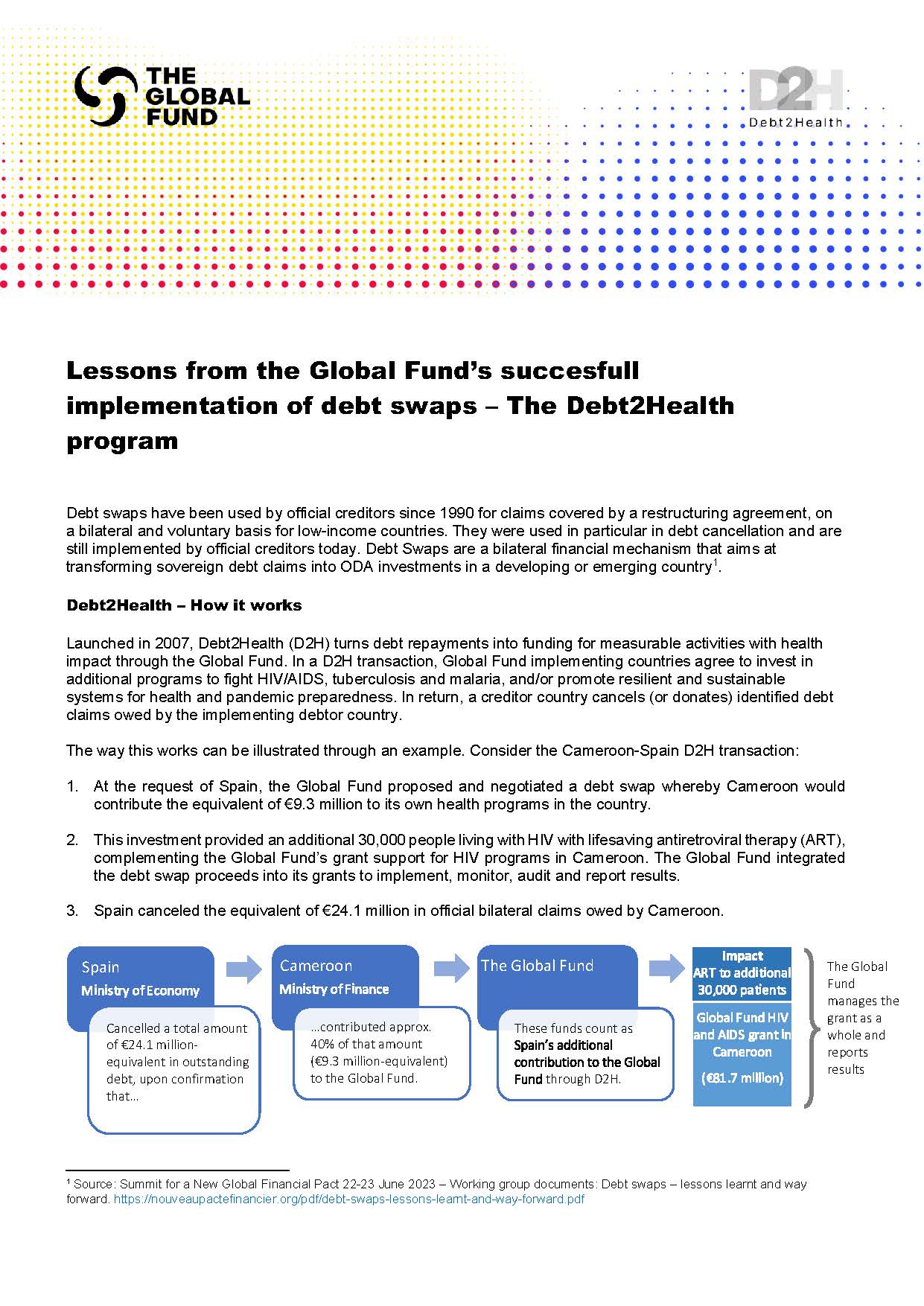

Beijing Symposium Recap on Global Health Financing–Debt Swaps for Health (D2H) are an innovative instrument for financing global health programs. Under D2H, a creditor country relinquishes its rights to repayment of outstanding debt on the condition that the debtor country channels part or all of this repayment to health programs in their own country. As so many countries in the global south are suffering under an increasing and debilitating debt burden while at the same time budgets for international support to health in their countries are under extreme pressure, debt swaps for health are offering a unique opportunity to combine a reduction of debt with increased domestic investments in life-saving health programs.

“The Brazilian G20 Presidency in 2024 has put Debt Swaps for Health high on their agenda and asked the JLI Center for Global Health Diplomacy to support this process based on its pioneering role in establishing this mechanism. It is now being explored by many creditor countries including China”, Benn says.

This specific form of debt swaps was launched at a replenishment conference of the Global Fund in 2007 under the leadership of the current director of the JLI Center for Global Health Diplomacy Christoph Benn and his Global Fund team at that time. They were building on the experience of debt swaps in other sectors such as environment and education. Given this role, Christoph Benn was asked to provide the keynote addresses at the G20 Health Experts Meeting Side event: “Debt for Health – past experiences and lessons learned” in Brasilia on April 9, 2024 and at a special symposium in Beijing on May 8 on global health financing.

The intention of the Brazilian G20 Presidency is to issue a policy paper for the G20 Finance and Health Ministers on debt-for-health swaps at its meeting later this year encouraging its wider use by countries and international organizations.

For additional reading, take a look at Prof. Kalipso Chalkidou’s piece on “Turning debt into health” @ https://www.linkedin.com/pulse/turning-debt-health-kalipso-chalkidou-qvuae/.